In December 2017, The Economic Times announced that the International North-South Transport Corridor (INSTC), which it hailed as a “game changer for India’s Eurasia policy”, was to be operationalised from mid-January 2018, with India to send its first consignment of goods via the Iranian port of Bandar Abbas to Russia. Alongside Bandar Abbas on the Strait of Hormuz, the port of Chabahar on the Gulf of Oman – as Iran’s sole Indian Ocean port – has also emerged as a key feeder port to the INSTC. India has already pledged around $500 million toward developing this strategically-located port that provides India, currently the world’s largest fastest growing large economy, with a transit route to Iran, Afghanistan, Central Asia and beyond that bypasses Pakistan, which has been reluctant to grant its regional rival overland access through its territory. In October-November 2017, India successfully despatched an inaugural consignment of around 15,000 tons of wheat from the Indian port of Kandla in Gujarat to Afghanistan via Chabahar, in line with its commitment to provide 1.1 million tons of wheat to Afghanistan on a grant basis. In February 2018, during the Iranian President Hassan Rouhani’s first state visit to India, India and Iran issued a joint statement that noted the inauguration of Chabahar Port Phase-1 in early-December 2017, Indian industrial investment in Chabahar Free Trade-Industrial Zone, India’s commitment to the development of the Chabahar-Zahedan rail line and the leasing agreement that gives operational rights of Chabahar’s Shahid-Besheshti port to India Ports Global Limited (IGPL) for 18 months. By the first week of April 2018, India had sent seven shipments of wheat to Afghanistan through Chabahar.

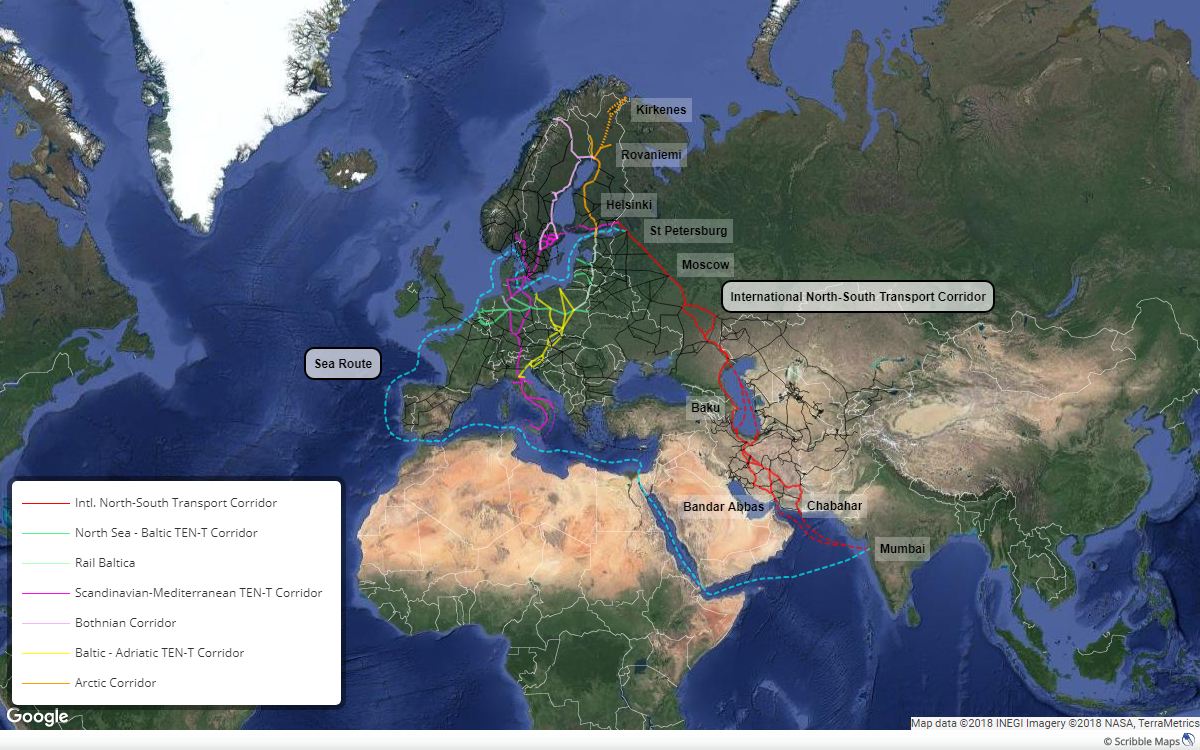

Since April 2018, moreover, the Federation of Freight Forwarders’ Association of India and the Kalinga Motor Sports Club, with the support of the Indian Ministry of External Affairs, the Indian Ministry of Commerce & Industry and other local partners, jointly hosted a INSTC Friendship Motor Rally to promote the INSTC. Starting in New Delhi, the route made its way down to Mumbai, then went over sea to Bandar Abbas, journeyed northwards through Iran and Azerbaijan to St Petersburg, and then from St Petersburg back to Chabahar. The rally was scheduled to be flagged down in Chabahar on 2 June 2018. Positioned by many in the media as India’s answer or preferred alternative to China’s Belt and Road Initiative and as part of a new Great Game where India and China are jostling for influence in “the playing field of the original imperial power rivalry in the 19th century: Iran and Central Asia”, INSTC is clearly drawing substantial attention in all of the countries along the corridor and, increasingly, also in the West. Much of the focus, however, is either on how this transcontinental corridor will impact the nature of Europe-Asia trade when it becomes fully operational or how it will connect with other Eurasian corridor plans. Yet, by linking Mumbai and New Delhi with Moscow and St Petersburg, the route is also significant in that it serves as India’s grand corridor not only to the largest Arctic state, but also to the Arctic, Nordic and Baltic regions. This article will shed light on the development of the INSTC, the opportunities it presents, the challenges it faces, its implications for European-Asian and Northern connectivity, and why India must engage more closely with European partners if the project is to succeed.

What is the INSTC?

Firstly, the International North-South Transport Corridor (or INSTC) is a joint initiative of India, Iran and Russia, which signed an agreement to this effect in 2000 and ratified it in 2002, with Azerbaijan joining the agreement in 2005. The four countries lie along the route of the corridor geographically and are building it to secure common economic interests with the free flow of goods and passengers. The INSTC is emerging at a time when the Chinese-backed Belt and Road Initiative (BRI), a grand scheme of a transnational transportation corridor spanning a total of 68 countries in Europe, Asia and even Africa, has started reshaping the global rules of trade in favour of China. The INSTC is dwarfed by the BRI; however, it still remains important as it reflects the determined will of the founding member countries to tread in a direction that is distinctive from the one prescribed by China.

The INSTC is a land- and sea-based multi-modal transport network that will connect the Indian Ocean and the Persian Gulf with the Caspian Sea and then onwards to Russia and even northern Europe (which is presently being discussed). The corridor, meant for both passenger and cargo transportation, is 7,200 kilometers (4,478 miles) in length between the port of Mumbai and St Petersburg. Already two dry runs have been successfully conducted along the route of the corridor. The results have shown that transportation costs for goods travelling along the INSTC could be cut by $2,500 per 15 tons of cargo, and transit time could be reduced to 25-30 days compared to 40-60 days taken at present via the Suez Canal route. The INSTC reduces carriage costs by 30% and transit time by 40%. Take the route between Mumbai and Moscow, for instance: the traditional sea route is 8,700 nautical miles (around 16,112 kilometers) and would take 32-37 days, compared to the INSTC, which is just 2,200 nautical miles (around 4,074 kilometers) plus 3,000 kilometers (overland) and would take only 19 days. Now, take the route between New Delhi and Helsinki: while the traditional route via sea is 16,129-kilometer-long and takes 45 days, the new rail route opened up by the INSTC is 9,389-kilometer-long and takes just 21 days.

Given these advantages not only for India and Russia but also the countries en route, the corridor is attracting the interest of a growing number of countries across Europe and Asia. At present, it has 10 member countries further to the four (India, Iran, Russia and Azerbaijan) mentioned above, namely – Belarus, Ukraine, Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Turkey, Armenia, Syrian Arab Republic and Oman; Bulgaria is an observer member. Moreover, many countries from around the world, such as Finland, Estonia, Latvia and Pakistan, have expressed their interest to join it; others, such as Turkmenistan, may not be formal members but are likely to be linked to it; yet others, such as Myanmar, Thailand, Cambodia, Laos and Vietnam, are to get linked with India through the India-Myanmar-Thailand Highway Project and East-West Economic Corridor, opening up the possibility of future expansion of the INSTC to Southeast Asia; while a few, such as the US and Japan, have reportedly endorsed it, though the recent hardening of the US posture against Iran and Western posture against Russia may have significant implications. The US withdrawal from the Iran nuclear deal, the US sanctions on Iran and the Western sanctions on Russia particularly affect India that has long-standing political, commercial and/or defence ties with the US, Iran and Russia.

Who is financing the INSTC?

There is also the question of financing projects relating to the INSTC. While India has backed the development of the port, free trade zone and railway line at Chabahar, Azerbaijan has come to Iran’s aid to expedite the completion of the Iranian section of the corridor. Furthermore, much to India’s discontent, Iran stated recently it would be open to Chinese and Pakistani investment to speed up the Chabahar project, while India appears more open to Japanese involvement, with the two Asian powerhouses collaborating on the Asia-Africa Growth Corridor (AAGC). It was reported recently that Japan International Cooperation Agency (JICA), Japan Bank for International Cooperation (JICA) and various Japanese banks may be interested in financing INSTC and investing in the Chabahar Free Trade-Industrial Zone, though the US sanctions in Iran are likely to deter Japanese participation. Moreover, multilateral organisations are stepping in to support the INSTC in different ways. The Asian Development Bank (ADB) has increased the line of credit to Azerbaijan from $200 million to $400 million for the development of the 441-kilometer Baku-Yalama railway line – connecting the capital of Azerbaijan with the Yalama border crossing point at the Azerbaijani-Russia border – that comes within the framework of INSTC. Also, the French Development Agency (Agence Française de Développement, AFD) is said to be providing another $175 million as co-financing. Both ADB and Islamic Development Bank have provided loan financing to the Kazakhstan-Turkmenistan-Iran railway link that is also being funded by the governments of Kazakhstan, Turkmenistan and Iran. In 2012, the German rail company Deutsche Bahn conveyed interest in using INSTC to deliver goods from Europe to Iran via Azerbaijan, but it did not broach the topic of financing.

Then, there is the question of the missing links in the envisaged multi-modal network. One major missing link along the corridor – the 164-kilometer-long rail line between the two Iranian cities of Qazvin, an important centre of culture and trade that served as the capital of the Safavid Empire, and Rasht, the largest city on Iran’s Caspian Sea coast – is likely to be completed within the next month or so, possibly in June 2018. Likewise, another missing link – the 167-kilometer standard gauge rail line connecting Rasht and Astara, an Iranian Caspian Sea town on the border with Azerbaijan a short distance away from the Azerbaijani border town also called Astara – is supposed to be completed over the next three years, with Azerbaijan allocating $500 million or 50% of the financing as a loan. Concerned sources in India say that this will pave the way for the project to function fully in a few months. Realistically, though, this may not happen as important sections along the corridor would still require to be effectively connected or upgraded to the extent of becoming traversable. Nevertheless, at present, the momentum is catching up as high-level policy dialogues and on-the-ground advances are propelling the INSTC to become a new infrastructural, economic, political and social reality.

The Major Challenges

An important question that shrouds the INSTC is whether it has the wherewithal to become economically viable and practically relevant at a time when other Euro-Asian corridors (not just BRI, but also others, like the New Silk Road Initiative and the Lapis Lazuli Eurasian Corridor) have emerged or are starting to emerge? If not, how can the INSTC be shaped in a way that would make it unique and multi-purpose vis-à-vis other emerging Euro-Asian corridors? Hereon, this article identifies some of the pertinent lacunae that may prevent the INSTC from growing to its optimum potential.

From the time of its very conceptualisation, the INSTC has failed to secure full-fledged involvement of the private sector. There are many reasons behind this, and not just the one that is most commonly held – the US sanctions on Iran. The sanctions did play a role in preventing some Western multilateral companies from entering the Iranian market; however, that, by no means, prevented them from participating in a multi-country project that in itself has not come under any form of sanction. The large companies have feared that there are high risks associated with their return on investment in developing the project. For instance, in 2004, a consortium led by Ashok Leyland Project Services (ALPS), a Hinduja Group company, entered into two agreements with the Ports and Shipping Organisation of Iran, the first to develop the Chabahar port on a BOOT (build, own, operate, transfer) basis, and the second to develop a rail line connecting Chabahar, Fahraj and Bam on a BLT (build, lease, transfer) basis, collectively costing an estimated $600 million. By November 2008, however, it was reported that disagreements with Iran, which insisted on a BOT (build, operate, transfer) model for the rail project, led to Iran threatening to call off the negotiations with ALPS and offer the project to a Chinese firm instead. Although India financed and completed the $135-million, 218-kilometer Delaram-Zaranj Highway (Route 606) in Afghanistan in 2009, little came out of the agreement with Iran. The reasons were manifold: bureaucratic inefficiencies, economic realities, corruption and, of course, US pressure on India to limit ties with Iran. Even today, given the high risks involved, many private sector players feel that the INSTC project lacks the economic merit for investment as it would allow them limited scope to participate freely in trade activities that would ensue once it gets fully constructed.

The concerns of private sector players are rendered valid if past incidents involving arbitrary actions of the Iranian and Russian governments against foreign companies, operating within their national territories, are anything to go by. In 2002, Iran awarded the Farsi block in the Persian Gulf to an Indian consortium – led by ONGC Videsh Limited (OVL), the overseas arm of India’s Oil and Natural Gas Corporation (ONGC), and comprising also Indian Oil Company (IOC) and Oil India Ltd (OIL) – for exploration. However, given all the regulations that Iran has in place preventing foreign entities from owning oil or gas resources in Iran or project promoters from taking out oil or gas from Iran, the OVL-led consortium had to bear all exploration-related risks, was guaranteed reimbursement only after commercial viability was established and had to develop the field through service contracts. The consortium discovered the Farzad-B gas field in the block in 2006, declared it commercial in 2008, and submitted a Master Development Plan (MDP) in 2009 and revised MDP in 2010 proposing to invest more than $5 billion in developing the field. However, once again, the threat of US sanctions deterred it from signing the agreement, leading to a retaliatory ultimatum by Iran that threatened to cancel awarding the development rights to the consortium. The ensuing negotiations – and “blame game” – between India and Iran over differences in expected and offered rates of return on investment, who buys the gas (India or Iran), at what rate it should be sold, and how much should Indian firms be involved (upstream, downstream or both) led to Iran turning to Russian firms, and India instructing its state refineries to reduce oil purchases from Iran. In 2017, though the Indian consortium raised their offer to $11 billion for the development of both the field and the LNG export facility, it was not easy to secure developments rights. Subsequently, the consortium shelved the plan for the LNG export facility and decided to focus only on upstream field development for which they recently put a lower offer. This protracted episode presents a case in point about why high political risks may deter private-sector investment. Moreover, international private companies are skeptical of operating along the INSTC due to the lack of uniform legal standards and safeguards for the transportation of goods, including raw materials and finished products.

In recent times, advanced digital technologies have revolutionised the way that trade is being undertaken, and financial transactions are being made at all levels, ranging from intra-company to regional and global. New technologies, such as smart energy, cloud computing, 3D printing, humanised big data, smart algorithms and artificially intelligent robots, are making work activities easier, driving up innovation, increasing the level of coordination and cooperation between humans located far and near, and even transforming the design, construction and operations of infrastructure. As one industry professional at the software corporation Autodesk recently mentioned, “[W]e will see a shift towards outcomes-based design, where the technology will do the heavy lifting, supporting exploration of thousands of permutations of design across multiple dimensions to achieve a particular outcome. The designer will be able to focus more on the bigger issues of what social, economic or environmental outcome they’re seeking.” By improving the predictability of outcome through techniques such as machine-learning, public and private sector players can provide clearer, less-uncertain and more robust proposals to investors. It is again the private companies that have an edge in the latest technologies in the global market as compared to the public agencies. However, the lacklustre attitude of the private sector when it comes to participating in developing the corridor, and the accompanying lack in the application of digital technologies, is obstructing the INSTC from emerging as a trade route that will fully cater to the needs of various actors within its business ecosystem.

The present design of the INSTC is limited in terms of territorial reach and scope of scaling up businesses. It lays exclusive emphasis on connecting the missing links along the identified passage, while mostly ignoring the need to build infrastructure, such as ports, harbours, townships and hotels, alongside that would promote and sustain the trade activities. Furthermore, there is no joint work-plan/strategic roadmap for developing the corridor and its surrounding business ecosystem. These structural loopholes are not irreversible; they are the underlying opportunities to be capitalised upon by member parties to maximise shared benefits.

Proposed Way Forward: Synchronisation with Baltic, Nordic and Arctic Transportation Corridors

The INSTC needs to become a truly transcontinental corridor, if it is to attain economic viability. This essentially means that it should connect physically with a greater number of countries in Europe, extending its reach beyond the present termination point of St Petersburg in Russia and expanding northwards and westwards to get more integrated with European rail networks. In recent months, there have been high-level level discussions about stretching the corridor further to include countries such as Latvia, Estonia and Finland. However, this is happening at a relatively slow pace and mostly on bilateral or trilateral terms, featuring one of two of the Nordic and Baltic states and then principally India, Russia, Iran, Azerbaijan and/or Afghanistan. As the Baltic and Nordic regions, particularly in conjunction with the European Union (EU), are already collaborating on significant transport initiatives, it might be worth exploring how these – often EU-supported – projects could be integrated or synchronised with the INSTC.

Of the 9 Core Network Corridors identified to streamline the coordination and development of the European Commission’s Trans-European Transport Network (TEN-T) Core Network, three are of immediate relevance to the INSTC: the North Sea-Baltic TEN-T Core Network Corridor, the Scandinavian-Mediterranean TEN-T Core Network Corridor and the Baltic-Adriatic TENT-T Core Network Corridor. The first of these is particularly relevant. At present, Estonia, Latvia and Lithuania, as also Finland and Poland, are cooperating on Rail Baltica, the largest Baltic-region infrastructure project in a century that aims to integrate the Baltic States in the European rail network. The project falls within the scope of the North Sea-Baltic Corridor and is to develop a European standard gauge railway that links the three Baltic states with Poland. It is to include new intermodal freight terminals and multi-modal passenger terminals, and connect Helsinki, Tallinn, Pärnu, Riga Central, Riga Aiport, Panevežys, Kaunas, Vilnius and Warsaw. As Warsaw is already linked to Berlin by rail, the Baltic states would benefit from a corridor that goes onwards to the major cities and ports of Europe – Hamburg, Bremen, Bremerhaven, Cologne, Frankfurt, Amsterdam, Rotterdam, Brussels and Antwerp.

If some Baltic and Nordic states – namely, Latvia, Estonia and Finland – simultaneously pursue integration with the European rail network and the INSTC as they have, and if their efforts are successful, then they would link INSTC member countries, such as India, with Northern and Western Europe and provide an impetus to European-Asian connectivity. More importantly, they could emerge as the strategic transport hub and gateway for the two-way flows of people and products between Europe and Asia. In recent years, recognising the opportunities that India’s growing economy and the emerging INSTC would present to Latvia, the Baltic state appointed an Honorary Consul in India. In February 2017, Edvīns Bērzinš, President of the Latvian state-owned JSC Latvian Railway, visited India to discuss with senior government officials the support measures for Indian firms that use Latvia’s ports as a gateway for exports or imports to Northern Europe and Commonwealth of Independent States (CIS) markets, as well as the synchronisation of the Latvian Railways with the INSTC. Later that year, in November, the Latvian Prime Minister Maris Kučinskis led a trade delegation to India; championed the revival of the ‘Amber Way‘, an ancient route between India and Latvia; and said that Latvia’s participation in the INSTC would offer access to the Baltic Sea, with the Port of Riga and Latvian rail infrastructure enabling Latvia to serve as India’s gateway to Europe. The delegates at the summit also discussed the potential synchronisation of Rail Baltica with the INSTC. Latvia and India also planned a pilot container train service from Mumbai to Riga via the corridor in 2018.

Alongside the North Sea-Baltic Corridor, there would also be scope for the synchronisation of the INSTC with the Scandinavian-Mediterranean (ScanMed) Corridor that stretches from the Finnish-Russian border to Sweden, Norway and Denmark and then southwards to connect these Nordic and Arctic states with Germany, Austria, Italy and even Malta. The partly EU-funded Twin-Port projects, which seek to increase the transport capacity and infrastructure efficiency of the Helsini-Tallinn route and fall within the framework of the EU’s Motorways of the Sea (MoS) program, connect the North Sea-Baltic and ScanMed Corridors. In addition, efforts to improve port interconnections and upgrade rail infrastructure between Helsinki and Finland’s largest universal, export and transshipment port at HaminaKotka, which is just around 35 kilometers west of the Russian border and 250 kilometers west of St Petersburg, will prove particularly relevant and advantageous with respect to the INSTC. Similarly, projects to upgrade the maritime link between the ports of Turku, Stockholm and Mariehamn along the ScanMed Corridor and the Baltic MoS link between Helsinki and Lübeck, as well as to construct the Helsinki Rail loop, improve the Helsinki railway yard and add a track and platform at Pasila, would benefit from synchronisation with the INSTC.

Likewise, the integration of the Baltic states in the European rail network will also allow them to reap the benefits of multi-modal transport infrastructure development in the Baltic-Adriatic Corridor, which will connect Baltic ports, such as Gdansk, Gdynia, Szczecin and Świnoujście in Poland, to Adriatic ports, such as Koper, Trieste, Venice and Ravenna, through Warsaw, Lodz and Poznan that also fall within the North Sea-Baltic Corridor. Consequently, there is also scope for the INSTC to be synchronised with countries such as Poland, Czech Republic, Slovakia, Austria, Slovenia and Italy, though the value of the INSTC, compared to the sea route via Suez Canal, for trade with Southern Europe may be less pronounced for India.

Then, there is the case of the Bothnian Corridor where developments in the transport system would enhance connectivity between northern Sweden and Finland and the rest of Europe, as well as Russia. While southern Sweden and Finland clearly come under the ScanMed Corridor, and the Helsinki region also comes under the North Sea-Baltic Corridor, the status of the Bothnian Corridor has been less clear. In recent years, however, senior EU officials, such as the European Coordinators of both the abovementioned corridors, have mulled over the importance of the Bothnian extension as a strategic gateway to the Arctic region and another potential intersection between the two other corridors. Earlier in 2018, Sweden’s Infrastructure Minister Tomas Eneroth announced that Sweden had requested the European Commission to extend the ScanMed Corridor to northern Sweden. The extension would buttress efforts to develop further the transport system in the northern regions of Sweden, Finland and Norway, particularly on the Iron Ore Line between Luleå, Kiruna and Narvik; the North Bothnia Line between Umeå and Luleå; the East Coast Line between Umeå and Sundsvall; as well as between Svappavaara and Kolari. These developments, furthermore, will integrate northern Norway, Sweden and Finland with the Baltic and wider European rail networks and, thus, link them with the INSTC, opening up the possibilities of greater trade and investment relations with India.

Finally, there could be deliberations on connecting the INSTC with the planned Arctic Corridor, which would connect Finland and Europe to the deep-water ports of the Arctic Ocean and the western tip of the Northern Sea Route. It is being widely touted that the Arctic Corridor, once complete, will be the shortest, most direct route to transport goods between Asia and Europe. China has already started negotiations to connect its BRI with the Arctic Corridor, both the rail links required between Finland and Norway and the rail tunnel required between Finland and Estonia; and reports claim that Chinese investors could finance two-thirds of the cost of building the world’s longest rail tunnel, connecting Tallinn and Helsinki. It would be prudent, and perhaps even necessary, for INSTC member countries, especially India, to consider ongoing and proposed infrastructure developments in the changing Arctic when it considers westwards or northwards expansion or integration of the INSTC, and the implications both of linking or not linking the INSTC to emerging rail developments between Estonia, Finland and Norway. As there have already been exchanges with Finland, Latvia and Estonia about their potential inclusion in the INSTC, INSTC member countries, particularly India, might wish to articulate how it plans to position the INSTC vis-à-vis, and engage with, China’s BRI in the region.

If the INSTC is to succeed in the long term and to expedite the process of establishing physical connectivity between Europe and Asia in the short-to-medium term, INSTC member countries such as India should consider the Northern Dimension more carefully; involve as partners a new set of countries, such as Norway, Sweden, Finland, Estonia, Latvia, Lithuania and Poland; and synchronise the INSTC with a new set of transport corridors, such as those linking the Nordic, Baltic and Arctic regions with the rest of Europe. It would help to open channels for communication and cooperation with a new set of regional institutions, such as the EU, the Nordic Council of Ministers, the Barents Euro-Arctic Council, the Barents Regional Council, the Council of the Baltic Sea States, the Arctic Council and the Arctic Economic Council. Once they have European members or partners, they could also look into the possibility of tapping into European Structural and Investment Funds, such as the European Regional Development Fund (ERDF) and the Cohesion Fund, particularly its Connecting Europe Facility (CEF), and the European Fund for Strategic Investments (EFSI). They might also wish to consider whether a new multi-modal transport agreement (such as the Ashgabat Agreement) might be needed to synchronise the INSTC with European corridors. If the full-fledged involvement of the EU and possibly Norway could be achieved, and if progress could be made in aligning legal standards and safeguards across the member countries along the corridor, this will clear many of the existing roadblocks for private sector investments. It could also help to increase the standardisation level of tradable goods (and services) along the entire corridor.

The INSTC member countries, including the ones waiting to become members, are starting to realise that they cannot afford to deal with the aforesaid agenda at a later stage, considering fast-changing geopolitical realities and emerging waves of Euro-Asian integration. Concertedly working towards that right away, not just among member states but crucially also with European partners, will increase the strength and utility of the corridor in the process. This will benefit their respective economic interests, as well as the collective interests of the Euro-Asian community. India, the world’s largest democracy and fastest growing big economy, might find itself walking on eggshells as it tries to maintain a delicate balance between its motley set of close allies and trading partners – the US, UK, Canada, Norway and the EU on the one hand and Russia and Iran on other. However, it is precisely that in-between position that it could use to play a leadership role in striking out a multi-party agreement for establishing rail, road and seaway connectivity to the Arctic and Bothnian Corridors, as well as to the North Sea-Baltic, Scandinavian-Mediterranean and Baltic-Adriatic Corridors, through the INSTC. Also, it would be in the interest of the Baltic, Nordic and Arctic states to look out for new possibilities for facilitating Europe-Asia trade, so as to have a diverse set of foreign investment options available, remain open to the massive infrastructure development initiatives backed by non-Baltic, non-Nordic and non-Arctic states while avoiding getting locked up in any one scheme, and ensure balance of power in the Baltic, Nordic and Arctic regions. In that sense, India could be precisely the partner they need.